It doesn’t make sense. You must be kidding. Aren’t these questions that cross your mind when you read the title? .

No one is born into this world worried, instead we are born worry free. Not worried about the country we are in, our ethnicity, not worried of our relationships with our parents, siblings, neighbors or as a matter of fact anyone. We are not worried if we are born rich or poor.

We are not worried about which school or college we get in to, what grades we would get, or what profession we chose. Not even worried how our financial sheet look like while we are working, or how it would be during retirement. The list is endless. You get the point.

Our entry pass into the world clearly reads as “BORN WORRY FREE”.

So no one would think that out of all these worries, we would be worried about this five letter word, “TAXES”.

Let’s dive deeper. There are two things that are certain in our lives, and something that each one of us will eventually have to encounter. These are “DEATH” and “TAXES”.

The main question is, what do we all pay taxes for? You would be surprised that you pay taxes – when you EARN, when you SPEND, when you SAVE, when you SELL, and even when you are DEAD.

What do you think about Taxes during Retirement? Do you have to pay them or does Uncle Sam magically appear and say, “Enough of these taxes, go ahead and enjoy your retirement tax free.” We wish. But that has never happened and not going to happen for at least another millennium.

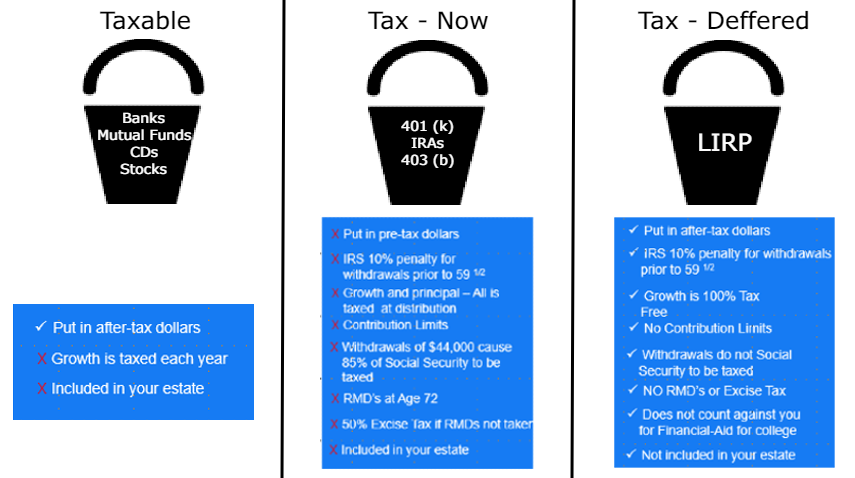

Now let’s start by drawing the correlation. We have established the fact that taxes are inevitable. We are also aware of the three Tax buckets – Tax Now, Tax Deferred and Tax Advantaged.

For this article I will explain the LIRP in detail.

LIRP stands for Life Insurance Retirement Planning. As per IRS 7702 Indexed Universal Life Insurance (IUL) allows you to take advantage of not only grow your money Tax Free but also take distributions tax free.

Indexed universal life insurance (IUL) is permanent life insurance that offers death benefit protection when death

Occurs. Your premium payments may earn interest and grow the cash value of your policy.

In addition to offering a traditional declared interest rate, IUL also offers the ability to earn interest that is linked to the movement of a selected stock market index over a specific period of time.

Even if the index goes down, your credited interest rate is never less than 0%. Guaranteed.

The manner in which interest is credited to your IUL policy gives you the potential for strong cash value

accumulation. A key benefit to remember is that it offers protection from market risk. With IUL, you don’t participate directly in the stock market and the credited interest rate is never less than zero percent, guaranteed.

Now one of the key parameters that defines the cash value on which you earn interest is how healthy you are today. The healthier you are that defines the underwriting class – Super Preferred (Healthiest), Preferred (Healthier) or standard (Least Healthy).

And one of the key to this classification is your Body Mass Index (BMI) which in turn is dependent on your weight.

BMI = Weight/Height

Let us say that your Height is ft. and 7inches and Weight is 155 Lb. Your BMI = 24.3 and if all your other health parameters are normal, with no medication you will be rated as Super Preferred.

Now say for instance your Weight is over 175 Lb. The BMI is 27.5, you may be rated as Preferred if all your other health parameters are normal, with no medication.

If your weight is over 200 Lb. that your BMI would be 31.3 and it would straightaway take you to The standard.

Based on your classification the higher your BMI the higher is your Cost of Insurance and thus lower is your cash accumulation that earns you Tax Free growth and possibly a tax free distribution if designed correctly.

So it is best to be in the best shape and be healthy today to purchase an IUL for you, so you can enjoy tax savings during your complete retirement.

This shows us that your weight today could be a big factor on a major portion of your taxes when you retire.

Don’t WAIT to lose WEIGHT.

At WealthBeing we believe that everyone is entitled to know how money works and how they can make it to work harder for them all the time.